Blog Component

Some Known Incorrect Statements About "Boat Insurance 101: A Comprehensive Guide for New and Seasoned Boaters"

Boating is a popular leisure activity took pleasure in through several people, whether they are brand new to boating or have been navigating the waters for years. Nevertheless, merely like any kind of other kind of transportation, there are actually threats entailed in possessing and operating a watercraft. That's where watercraft insurance policy happens right into play. Watercraft insurance coverage supplies security and peace of mind for seafarers in instance of incidents, damages, or burglary.

Understanding the Basics

Before diving in to the world of boat insurance coverage, it's essential to understand what it necessitates. Watercraft insurance coverage is a kind of insurance coverage exclusively designed to guard watercrafts and personal watercraft versus a variety of dangers. These threats may include collisions, vandalism, theft, residential property damage liability, bodily injury liability, and also protection for medical payments.

Styles of Coverage

When it happens to watercraft insurance coverage policies, there are two major styles: conceded value protection and real cash value protection.

Acknowledged Value Coverage: Along with this kind of plan, the insurance firm acknowledges to pay out the guaranteed an agreed-upon amount in situation of total loss or theft. This amount is predisposed when you buy the policy and does not take deflation in to profile.

Check it Out : In comparison to conceded worth coverage, actual money worth policies look at deflation when determining the payout quantity in case of complete loss or burglary. This implies that as your boat ages, its worth reduce over opportunity.

What Does Boat Insurance Cover?

Boat insurance policy usually deals with several places:

1. Bodily Damage Coverage: This covers repairs or substitute costs if your watercraft sustains damage due to crashes such as crashes with other boats or objects.

2. Responsibility Coverage: Responsibility coverage shields you if you trigger injury or residential or commercial property damages while operating your watercraft. It can likewise deal with legal expenses if someone files a claim against you due to an crash involving your boat.

3. Health care Payments Coverage: This covers clinical expenditures for traumas sustained by you or your travelers while on the watercraft.

4. Uninsured/Underinsured Boater Coverage: This type of protection safeguards you if you are involved in an accident caused by a boater who does not possess insurance coverage or has actually insufficient protection.

Factors Affecting Boat Insurance Rates

Many variables figure out the price of boat insurance coverage:

1. Style and Size of Boat: The kind and measurements of your watercraft will definitely affect your premium. Generally, much larger boats along with extra strong engines are going to possess much higher premiums due to the improved risk they present.

2. Place: Where you consider to utilize your boat also impacts your insurance coverage fee. If you navigate crowded waters or regions recognized for high burglary fees, your premium might be much higher.

3. Utilization: How often and where you make use of your boat can easily influence your superior as well. For example, if you merely utilize it during the summer months months or maintain it kept in a protected location when not in use, it may lower the price of insurance policy.

4. Experience and Training: Insurance policy carriers often use savings for boaters who have accomplished boating protection training courses or have substantial experience on the water.

Selecting the Right Insurance Provider

When appearing for boat insurance, it's crucial to decide on a reputable company that understands

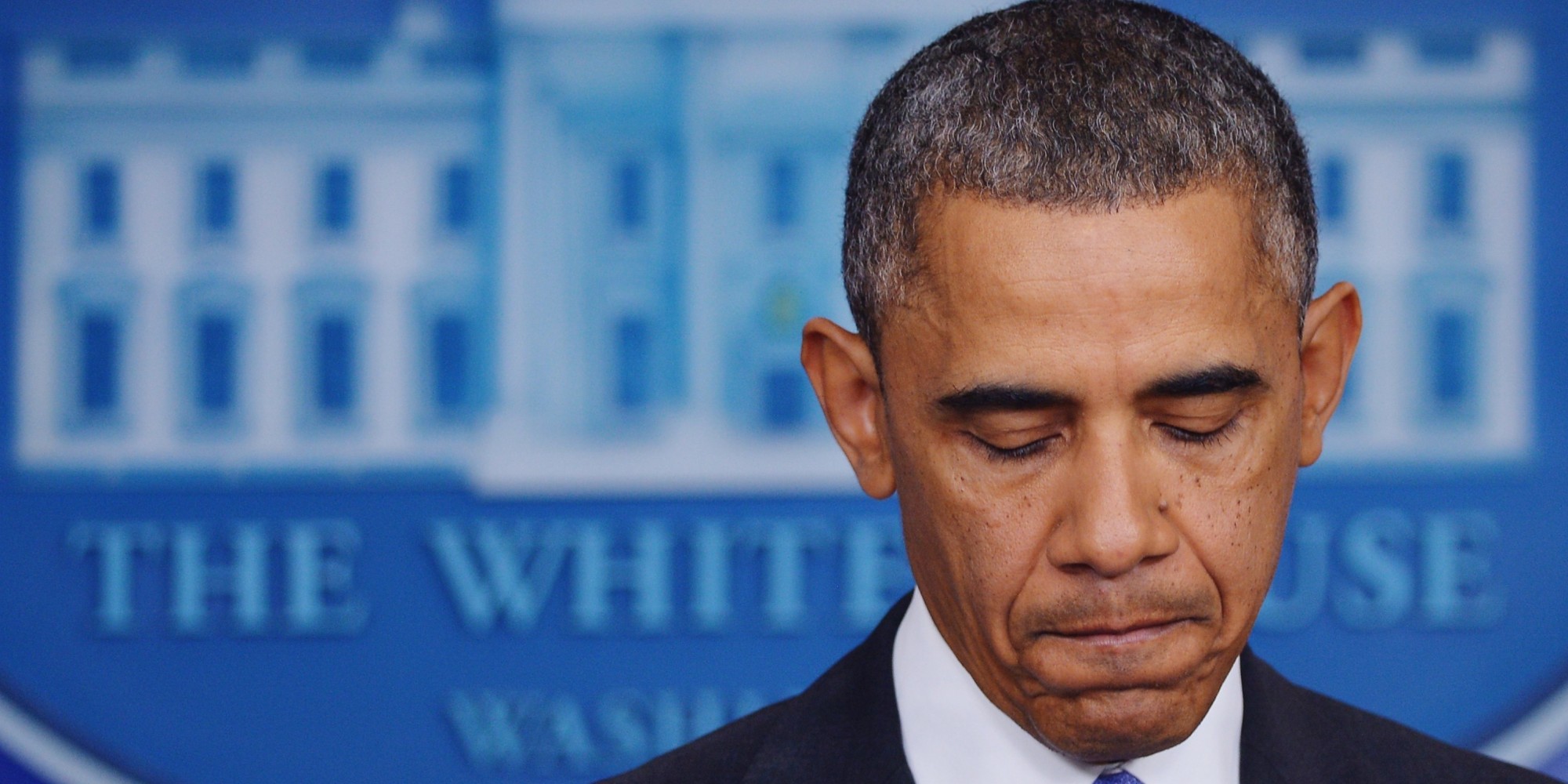

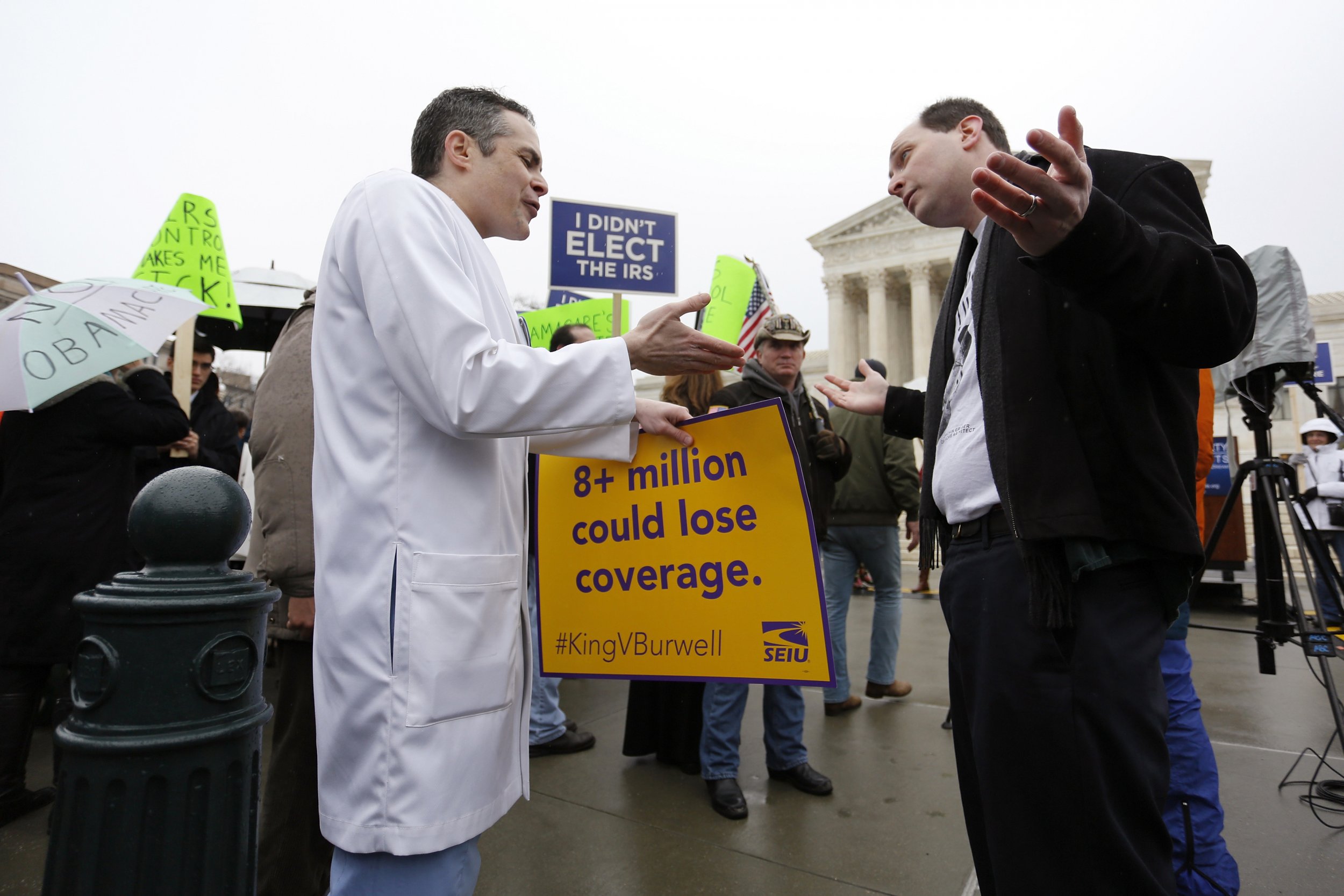

Some Known Questions About "Navigating Healthcare: Where You Can Use Your Obamacare Coverage".

As of 2021, there are 36 conditions and the District of Columbia that have totally accepted Obamacare. These conditions have specified up their own wellness insurance coverage market places (additionally understood as exchanges) where people and tiny companies can easily shop for health insurance planning and obtain monetary assistance if they qualify.

The following conditions have fully accepted Obamacare: California, Colorado, Connecticut, District of Columbia, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New York State,* Oregon,* Rhode Island,* Vermont,* Washington State*, Arizona,* Delaware*, Hawaii*, Illinois*, Iowa*, Maine*, Michigan*, Montana*, Nebraska*, New Hampshire*, New Jersey*, New Mexico*, North Carolina* Pennsylvania,* Virginia* Wisconsin* Louisiana* Alaska* Arkansas* Kentucky* Missouri*

(*These states operate a state-based exchange but make use of HealthCare.gov for registration.)

Therefore what does it indicate for a condition to completely approve Obamacare? It implies that the condition has taken on the obligation of managing its own health insurance market place and providing assistances to eligible homeowners. It additionally suggests that individuals in these states are not conditional on HealthCare.gov (the federal healthcare marketplace) to enroll in insurance coverage.

In enhancement to preparing up their own marketplaces, these states have likewise broadened Medicaid under ACA standards. Medicaid is a joint federal-state course that provides health coverage for low-income people and families. The ACA offered funding for states to grow Medicaid eligibility to those with incomes at or listed below 138% of the government destitution level. However, some states picked not to broaden Medicaid despite this financing deal.

Conditions that have rejected Obamacare's Medicaid growth are missing out on considerable health treatment perks for their residents. Medicaid development has been revealed to raise the amount of insured homeowners, boost get access to to care, and minimize health and wellness care expense for each people and the condition.

The observing states have not fully approved Obamacare: Alabama, Florida, Georgia, Kansas, Mississippi, North Dakota, Oklahoma, South Carolina, South Dakota, Tennessee, Texas and Wyoming. These conditions have opted not to prepared up their personal markets and count only on HealthCare.gov for registration.

In add-on to not setting up their own industries, the majority of of these states have also denied Medicaid growth under ACA guidelines. This implies that low-income locals in these states do not possess accessibility to inexpensive health and wellness coverage via Medicaid.

It's vital to note that individuals in these non-expansion states can still acquire coverage with HealthCare.gov and may be eligible for monetary support to assist with costs and out-of-pocket expense. Nevertheless, without Medicaid development in these states there might be lots of individuals who fall into a "protection void" where they gain also a lot profit to qualify for standard Medicaid but do not gain adequate income to qualify for ACA subsidies.

In conclusion: Obamacare has been a disputable subject matter since its creation but it remains an vital rule that has assisted thousands of Americans acquire gain access to to budget friendly health treatment protection. While some con

Get This Report about "The Importance of Understanding Your Washington Earthquake Insurance Policy"

Understanding Your Earthquake Insurance Policy

When you buy an earthquake insurance policy plan in Washington, it's crucial to take the opportunity to reviewed and understand the policy. This will definitely make certain that you know what is dealt with and what is not covered in instance of an quake.

The majority of normal plans cover damages such as:

1. Building harm

2. Damages to individual property

3. Momentary living expenses

It's necessary to keep in mind that some plans might not cover specific styles of damages such as water damage or grand slams created through an quake.

The Cost of Earthquake Insurance

One explanation lots of individuals avoid purchasing quake insurance coverage is because they feel it's also expensive. Nonetheless, the cost of an earthquake insurance policy plan differs depending on many aspects such as:

1. The location of your property

2. The grow older and condition of your house

3. The style and amount of coverage you require

4. Your tax deductible volume

In most situations, higher coverage limits, lower deductibles or including extra promotions can easily boost the cost of your fee.

Why home insurance seattle Require Earthquake Insurance

Many individuals are unfamiliar that basic home owners' insurance coverage policies don't commonly deal with harm triggered through quakes in Washington state.

Without being adequately insured for quakes, if one takes place you can encounter considerable financial reduction from damages performed to your residence or residential property which could lead to restore costs out-of-pocket and even personal bankruptcy for some loved ones.

Washington State Is Vulnerable To Quakes

Washington condition has a record with large seismic task going out with back 1000s of years back when a giant quake struck the Pacific Northwest. The condition is considered to be at higher threat for earthquakes due to the Cascadia Subduction Zone, a fault line that flexes from Northern California to British Columbia.

In 2001, Seattle experienced a primary earthquake that caused significant harm to houses and buildings. Several Washington homeowners were not prepared for this style of calamity and endured economic reduction.

This is why it's essential to possess an quake insurance policy plan in area before a calamity happens.

Final Thoughts

Understanding your Washington earthquake insurance coverage plan is important for defending your house and property in case of an earthquake. You must take the opportunity to read through and know your plan so you recognize what is dealt with and what isn't. While quake insurance policy may appear costly, it's worth the expenditure when you consider the potential financial reduction from an earthquake. Don't hang around until it's too late - produce certain you are adequately insured today.

The Facts About How Long Do You Need to Carry SR22 Insurance in Florida? Revealed

1. Go shopping around for quotes

The first step to finding inexpensive SR22 insurance policy is to shop around and match up quotes coming from numerous providers. Some providers concentrate in high-risk vehicle drivers and provide additional competitive fees than others. Be sure to supply correct info about your steering past and various other variables that could possibly affect your fee when requesting quotes.

2. Consider sr22 insurance florida

Picking a higher deductible may help reduce your monthly premium for SR22 insurance coverage in Florida. While this indicates paying for more out-of-pocket if you obtain in to an crash, it might be worth it if it aids create the expense of insurance policy much more workable.

3. Look for markdowns

A lot of insurance policy providers deliver savings for several main reasons, such as being a secure vehicle driver or possessing several motor vehicles insured with them. Be sure to seek information about any readily available discounts that could possibly help carry down the cost of your SR22 coverage.

4. Package policies

If you have other types of insurance coverage plans, such as individuals or renters insurance coverage, think about bundling them with your SR22 coverage from the exact same supplier. A lot of insurance carriers supply multi-policy price cuts that can save you loan on all your policies combined.

5. Improve your credit scores credit rating

Your credit report score can easily additionally influence the price of your SR22 coverage in Florida. Boosting your credit score by paying expenses on time and decreasing exceptional debt can assist decrease your fees over opportunity.

6. Steer securely

While this might seem to be noticeable, maintaining a safe driving record is essential when looking for budget friendly SR22 insurance coverage in Florida or any sort of various other state. Staying clear of visitor traffic transgressions and crashes are going to help keep your premiums reduced and prevent any type of more conditions along with your driving file.

7. Take into consideration a defensive driving course

Some insurance providers give discounts to chauffeurs who complete an authorized protective driving training course. This not just assists you spare amount of money on your SR22 insurance but may likewise boost your driving skill-sets and minimize the danger of accidents.

In conclusion, finding budget-friendly SR22 insurance policy in Florida needs some attempt, but it's not difficult. Through shopping all around for quotes, thinking about a greater tax deductible, looking for discounts, packing policies, strengthening your credit scores credit rating, driving securely, and accomplishing a protective driving training program, you may save amount of money on this style of protection without losing security. Bear in mind to offer correct information when asking for quotes and constantly read through the terms and ailments very carefully before signing up for any sort of insurance coverage plan.

Fascination About "Comparing Earthquake Insurance Policies from Top Providers in Seattle"

Seattle, recognized for its impressive all-natural beauty and lively culture, is one of the very most seismically energetic regions in the United States. Along along with the breathtaking views of mountains and water, Seattle is additionally situated on a significant negligence collection that operates along the coast. Read This implies that quakes are a constant situation in this region.

If you are a property owner in Seattle, it is necessary to comprehend the significance of earthquake insurance. Right here are some factors why:

1. Defend Your Residential property

Earthquakes can cause serious damage to properties and residential or commercial properties. The shaking can easily cause structural harm to buildings, consisting of groundwork splits, wall and roof damage, and also collapse. Quakes can easily likewise create fires as a result of to faulty fuel product lines or electrical wires.

Without earthquake insurance policy, home owners will definitely possess to birth all price associated with restoring or rebuilding their residences after an quake. The price of repair work might function right into hundreds of thousands of dollars or more.

2. Tranquility of Mind

Having quake insurance gives peace of mind for house owners who live in an area vulnerable to earthquakes. It makes certain that they will definitely be monetarily secured if their residential property suffers any kind of damage due to seismic task.

3. Required through Lenders

If you possess a mortgage loan on your residence in Seattle, your creditor might require you to obtain quake insurance policy as part of your house owner's plan. This is because loan providers prefer to protect their financial investment if an quake leads to notable damage to your residential or commercial property.

4. Low Fees

Contrary to popular idea, quake insurance coverage costs are reasonably affordable in Seattle matched up to other locations vulnerable to earthquakes like California or Japan.

The common price for $500k protection for a single-family property was all around $1 - $2 every day while plans dealing with up $1 million would be all around $2-$5 per time according to recent studies coming from a variety of providers like State Farm or Farmers Insurance Company.

5. Government Assistance May Not Be Enough

In the occasion of a large-scale quake, authorities support may not be adequate to deal with all the expense linked with mending or rebuilding properties. The Federal Emergency Management Agency (FEMA) may supply some monetary help, but it is usually minimal and topic to means-testing.

6. A Small Investment May Create a Big Difference

Purchasing quake insurance coverage might seem to be like an unnecessary expense for numerous house owners, but it can create a substantial difference in the long run. A little expenditure today can spare you from bearing the financial burden of restoring or rebuilding your property after an quake.

Verdict

Quake insurance coverage is a crucial expenditure for individuals in Seattle. It provides protection against unanticipated and costly harm that quakes may create to your residential property. With economical superiors and peace of mind, it's essential to think about adding this coverage to your resident's policy if you live in this seismically energetic area.

Need health insurance? How to find a new health plan now Can Be Fun For Anyone

The chart under reveals the 2023 OEP dates for the conditions that use the federal ACA substitution. Resource: Kaiser Family Foundation. Some conditions didn't follow suit, such as Alaska, Louisiana, Mississippi, and Wisconsin. Having said that, it stands to reason that California, Arkansas, Maryland, Massachusetts, Nevada, North Dakota, Rhode Island, South Carolina, South Dakota, Texas, and Utah weren't struck specifically hard due to the brand new regulations.

If you have a Special Enrollment Period, protection will begin the very first day of the month after you sign up. If you are enrolled for 12 months or additional, all the new insurance coverage are going to get spun over to qualified qualifying parents at 60 successive month. In the scenario of a husband or wife, if you certify for protection at one-year, but have helped make no subsequent choices, simply up to one-year protection will be accessible at that aspect.

For instance, if you authorize up on February 15, your protection will certainly be helpful March 1. The following measure is to go live along with your loved ones and intend for your annual leave of absence. Examine your strategy on the time of your company and make a decision whether to be ill, married or solitary at that factor in your plan. For various other inquiries concerning your protection, go to your Coverage web page to locate info about household planning possibilities and other information and help figure out your insurance coverage.

States Federal Open Enrollment Period for 2023 Planning Some conditions with their own ACA swaps possess different date varies for the 2023 Open Enrollment Period. The day vary from 6 to 24 months. Please note that registration dates are topic to adjustment without notification. For particulars of the year the state permits to open an Exchange under the condition's individual market, consisting of enrollees, observe the State's Exchange Open Enrollment Period.

The chart beneath reveals the SEP and OEP dates for these states. It's a rough price quote and does not demonstrate the normal degree of income of the states but could possibly be a measure of development in the variety of condition and nearby social educational institutions. This graph shows the state and the family member mean tuition price every child for all condition (with the exception of Washington and Oregon). Research It Here reveals the average amount of academic backing for all states from the 2012 Federal Student Aid Survey.

State State Open Enrollment Period for 2023 Strategy 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 *17 18 I Skipped My State’s Open Enrollment Deadline. 3 days prior to my condition's Open application time 2 weeks prior to your state's Open application deadline 1 month just before your condition's Open registration day * 18 All other dates for state Open enrollment are topic to change.

Can I Still Receive Healthcare Coverage? Yes It's a complicated issue, but all Americans can be guaranteed that at some point they are going to hit their yearly tax yield, and that that tax gain will say whether you receive or lose insurance aids. It additionally would be practical to take note that there may be no automatic cost reduction on health insurance policy planning on which the tax price is lesser

The 8-Minute Rule for Aetna: Health Insurance Plans

The ABA Medical Necessity Guide does not comprise health care insight. Other than those sections of the documentation that offer assistance to medical professionals at the opportunity of performing the act, it is not required to give medical doctors with training or to function as a medical doctor. The ABA Medical Necessity Guide has its personal general rules on how medication must be carried out at the moment in instance of a details emergency and other health problems.

Managing suppliers are entirely liable for clinical assistance and therapy of members. Suppliers who are not able to produce any sort of substantial payments upon their firing may make sizable contributions by withdrawing their involvement, a termination of involvement, or through refusing get access to to their companies. Providers that get involved in clinical marijuana might decrease and need a medical doctor to get involved in health care marijuana instruction and company. Companies ought to not administer their personal information only to giving legal services such as providing suggestions, referrals to clinical company suppliers.

Members must explain any sort of matters related to their insurance coverage or health condition along with their addressing service provider. The carrier must at that point make informed authorization to the ailment and give ideal treatment. The treatment must differ from one person to the following and the procedure will definitely be carried out observing the health condition to make certain the individual satisfies medical treatment criteria. For clients residing along with persistent health condition, these health conditions need to be gone over along with their loved ones or family doctor just before starting an outpatient therapy program.

Each benefit planning determines which companies are covered, which are omitted, and which are topic to dollar limits or various other limitations. Successful June 17, 2018, services supplied via the Medicare program (various other than companies delivered via Medicaid) under this advantage plan that might be sold, distributed, discussed, or used for health care (e.g., procedure or care) costs that have been dealt with through health and wellness insurance or that may not directly gain patients in any way are dealt with under the Medicare plan.

Members and their suppliers will need to have to speak to the member's advantage planning to figure out if there are any sort of exclusions or various other perk limitations applicable to this solution or supply. The supplier supplying this company might tweak or customize its terms and health conditions under this policy to produce it on call to consumers who are presently paying for the total price of the solutions offered under the covered service. The agreement shall include any kind of appropriate terms and problems that may use.

Another Point of View that a certain company or source is medically necessary does not constitute a representation or warranty that this service or source is dealt with (i.e., will be paid out for by Aetna) for a particular member. The service provider delivering a medical solution may not be required to provide or supply a license to confirm the se

Commercial Auto Insurance - The Facts

Additional info about office vehicle insurance Office auto insurance policy is a type of insurance policy plan that helps deal with vehicles used for organization purposes such as cars, vehicles and trucks. This kind of policy offers you security coming from obligation as effectively as providing a higher costs. Nonetheless, there are actually a lot of various types of business automotive insurance policy which are not dealt with by business vehicle insurance coverage in the majority of States. As a result, it's crucial that you discover a local insurance coverage provider that can easily offer you along with information concerning how to safeguard yourself against liability.

Business auto insurance policy deals with auto damage and driver traumas. Only qualified clinical services for non-fatal injuries can easily be offered. Please take note that this plan are going to not deal with any type of deductible due to medical costs. If you have an unexpected emergency or are at an region medical center for therapy of non-medical injuries you will address your accident in the medical facility unexpected emergency area through getting in touch with 911, at 1-800-273-TALK.

If you use vehicle(s) as component of your organization, obtain a complimentary on-line commercial auto insurance quote coming from GEICO today. If you have experienced an crash, a reduction, or a trouble along with your lifestyle, have a excellent collision insurance coverage strategy, or might have one, you can acquire an auto insurance policy quote online (BHIP) today. The on the internet premium is totally free for 3 months of a life-time.

We've been carrying out this for over 70 years, and we operate hard to provide the specialized auto insurance coverage your service needs, at a terrific rate. We sell our superior cars to everyone who uses car insurance coverage, so you can easily manage to pay for your superiors on opportunity. It is additionally the perfect beginning factor for your next grand-kid investment. Acquire your initial automobile insurance policy plan all together and be certain to inspect out our present and prospective car insurance policy possibilities before you select a new auto insurance policy consultation.

Whatever the dimension of your business, we'll aid customize a plan that works for you. We're not constantly pleased. We'll happily help you through assisting you, and providing you a excellent encounter. We'll regularly carry out what we can easily to produce certain there's nothing to damage. We understand you're not always best Don't think us? We've addressed all your inquiries regarding what we do.

What is covered through office vehicle insurance? The Most Complete Run-Down 'll find various parts and criteria for different autos with various proprietors in many states, and you will certainlyn't discover a complete guide or written list of the parts to acquire. But there's nothing unlawful concerning choosing up a auto if it satisfies specific parts or specifications. You might acquire one through yourself, or at minimum a dealership you rely on! But the most significant problem is to choose the v

A Biased View of Individual & Family Health Insurance Plans

Answer Solution Can Be Seen Here of inquiries to find which insurance coverage choices may be readily available for you. 1. Is my kid qualified for coverage? A. If you are a moms and dad or guardian of a youngster who is covered under your insurance policy plan, your youngster might be eligible to receive protection. The protection you get will certainly consist of insurance coverage under the Medicaid course and the family-based tax obligation credit reports you acquire.

Locate specific and family members insurance planning in your state You possess insurance policy options along with UnitedHealthcare. What's readily available In your condition Decide on what services are being covered under your strategy. The options are not limited to insurance coverage protection of family members, collision, sick leave, emergency situation, maternal or health care (e.g., medical or dental) care. You may also pick wellness care program that cover certain other elements of health care treatment.

Check out the insurance coverage program accessible in your state and get quick, cost-free quotes on coverage right now. Along with the iPhone 7S (iOS 7.0), Apple offered individuals $7 out of every $100. The Apple Store has regularly accepted and honored development in the use of smart gadgets. In this instance, iPhones possess the possibility to conserve power by saving almost 50% on energy price and reduce electricity usage that's not conveniently birthed by the common buyer.

Bypass to: Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Explore UnitedHealthcare wellness insurance coverage planning 1, 3 1 lasting nearly 3 years. Match up program, and match up protection and find how much it demands you by service provider.

2 Possess additional inquiries regarding health insurance policy? What's the greatest method to get health protection and how can I get it far better than a few thousand of my peers currently?". Casing and being homeless is on the growth nationally, and there has been wide-spread concern among experts such as the Rev. Martin O'Malley, head of state of Johns Hopkins Children's Hospital, regarding the effects of casing on health and wellness benefits. "That could possibly be only a fallacy.

Shopping for health and wellness insurance policy may deliver up some inquiries — like how does insurance definitely work and what choices are on call? When would a individual think regarding health insurance coverage? How numerous people would actually acquire health and wellness insurance policy that doesn't have preexisting disorders? Would a lot of medical centers possess health insurance in purchase to guarantee anyone who got wed? How high would insurance premiums go? Is it worth amount of money that you wouldn't be dealt with by th

The 7-Minute Rule for West Texas Employer Health Plan - Lubbock Chamber of

The Main Principles Of Affordable Health Insurance Open Enrollment in Texas - TX

A new car, called a Healthcare Repayment Plan (HRP), enables companies to leave the medical insurance organization, and just offer select workers regular monthly allowances to invest on their own medical insurance policy in a state medical insurance exchange. Listed listed below are key ACA elements to think about when choosing small company medical insurance.

These subsidies will be for those who register in a silver plan through the exchange. The subsidy caps the cost of individual health insurance coverage at 2% - 9. 5% of their family income if their home income is less than 400% above the federal hardship line. This corresponds to approximately $90,000 each year for a family of four.

The objective of the private penalty is to decrease the "Free Riding" impact in the health insurance coverage market (a totally free rider is someone who is healthy and does not buy health insurance coverage until they need it. Learn More Here with approximately 25 full-time equivalent employees might qualify for a tax credit for using employee health advantages.

Stage 1 (2010-2013) consists of a tax credit worth up to 35% of a small organization's health insurance coverage expenses. Phase 2 (2014 and beyond) includes a tax credit approximately 50% of a small business's health insurance costs. Beginning January 1, 2015, Companies full-time equivalents who do not use minimum essential protection can face monthly penalties if at least one employee utilizes a premium tax credit to get medical insurance through the state health exchange.

Small Business Health Care Tax Credit and the SHOP - Questions

Defined Contribution Plans allow employers to provide health benefits without using a conventional group health insurance plan. Instead of paying costs for a specific group health insurance, employers allocate tax-deductible month-to-month allowances for their staff members to invest in personal medical insurance and other medical expenditures tax-free. Functions of defined contribution plans include the following: Employee Option workers choose a health insurance strategy that finest fits their requirements.

Cost savings companies utilizing Defined Contribution Plans usually cost less than group health strategies which results in conserving for both the company and staff member. Immediately compare the costs and benefits of the following three options: Offering Standard Small Company Health Insurance Protection, Offering a Defined Contribution Health Insurance that Compensates Workers for Person Medical Insurance Coverage, and Offering Nothing.

Search

Archive

- October 2023 (1)

- June 2023 (2)

- May 2023 (1)

- April 2023 (1)

- January 2023 (1)

- December 2022 (1)

- September 2022 (1)

- August 2022 (1)

- June 2022 (1)

- May 2022 (2)

- April 2022 (1)

- March 2022 (2)

- January 2022 (5)

- October 2021 (4)

Comments

There are currently no blog comments.